|

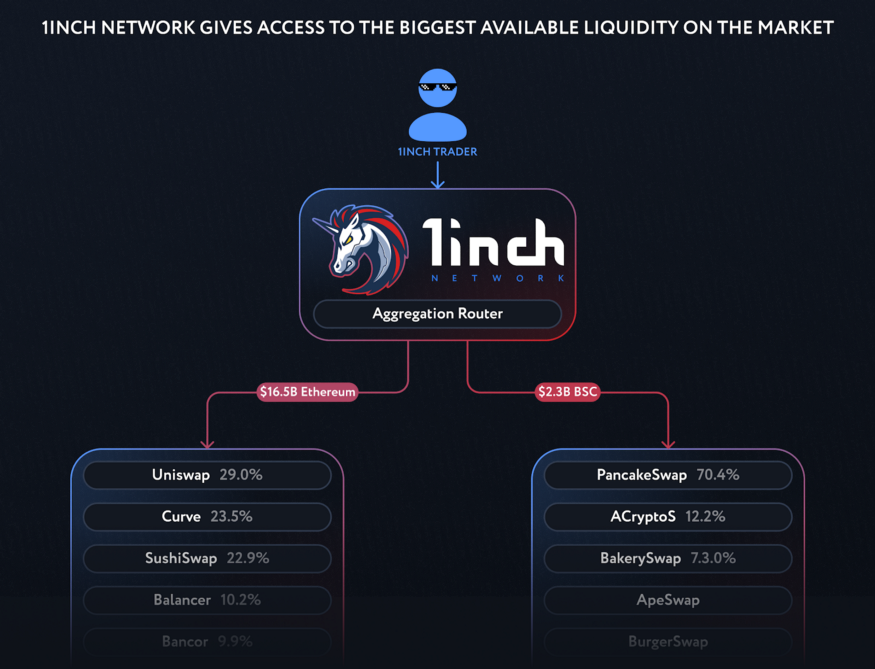

Decentralized exchanges are crypto exchanges that do not need to be governed by a third party. Anyone can trade on DEX, with only the need to link their wallets. Uniswap, SushiSwap, and PancakeSwap are a few examples. However, these exchanges sell cryptocurrencies at slightly varying prices. As a result, Ethereum may sell for different prices on different DEXes; each platform charges a different fee. So to get the best pricing from all DEXes, we need 1inch. In this article, we will get a complete understanding of 1inch.

Table of Contents What is 1inch?1inch is a DEX aggregator that connects many DEXes into a single platform, allowing users to locate the most economical exchanging routes across all platforms. Why do we need a DEX aggregator? Working of DEX Aggregator:

DEX aggregators operate by getting liquidity from many DExs, allowing them to provide customers with better token exchange rates than they could obtain on anyone DEX in the shortest amount of time.

Visit 1inch

We're excited to announce that xBTC has entered into an official partnership with @1inchExchange & @mooniswap, for their first all exclusive launch, ever!

Visit 1inch November: 1inch team announced v2. 1inch announced an integration with MyEtherWallet. December: 1inch released its crypto, i.e. 1INCH token on Christmas. On December 25, 2020, the 1INCH announced the first airdrop. Users who have used it before December 24, 2020, can claim these tokens. 1inch team also announced the completion of a $12 million fundraising round from investors such as Pantera Capital, ParaFi Capital, and Nima Capital. 2021

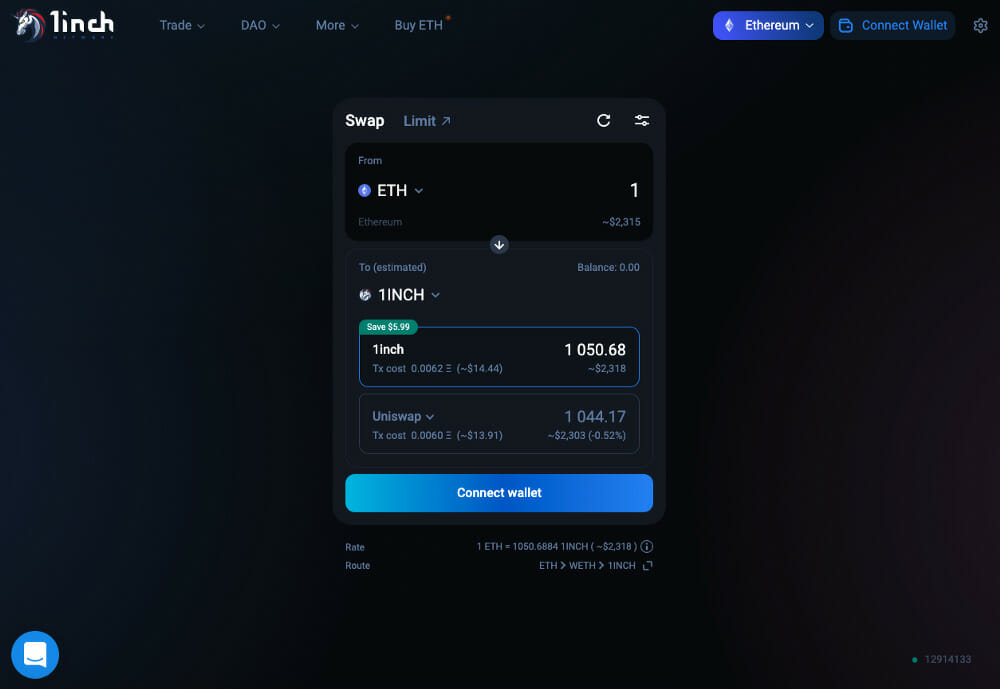

In this section, we will understand how to 1inch works. Step 1: BeginningSuppose we want to purchase some crypto X on a DEX using Ethereum. Then, we have to look at other DEXes; we will see that the rates and fees vary on different DEXes.

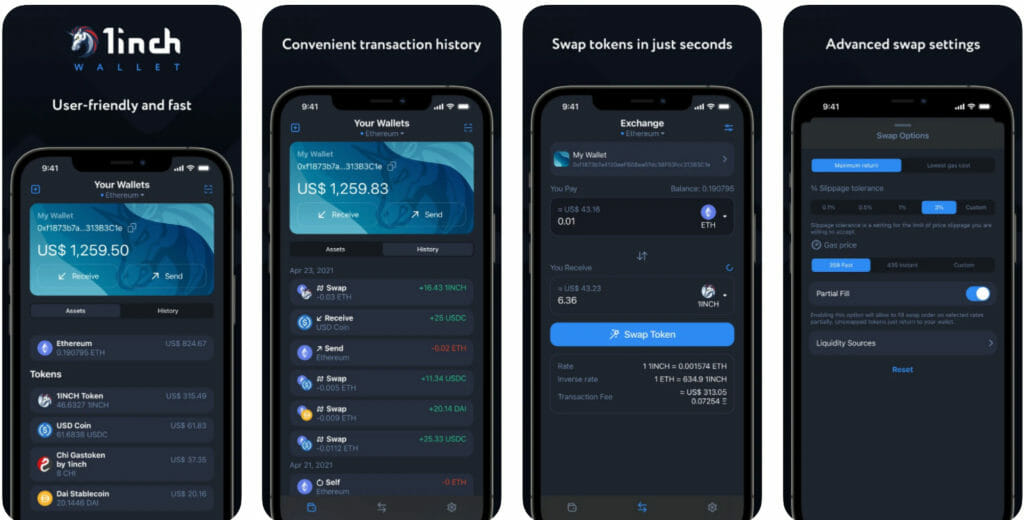

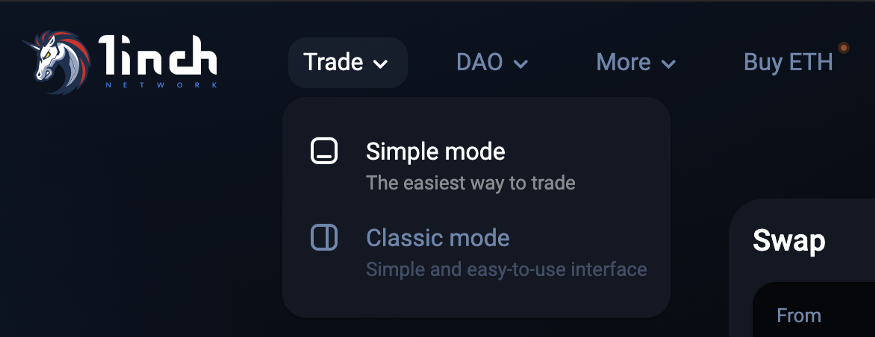

Visit 1inch Step 2: Algorithm1inch makes this easy. 1inch’s algorithm determines the cheapest way from all of the available exchanges and liquidity protocols. Step 3: ConclusionNow we can purchase the Crypto X from the best deal from a 1inch interface. What is the difference b/w Simple Mode and Classic Mode?Simple Mode It allows customers to swap crypto assets in a more user-friendly and simplified interface. It provides three swapping options; 1inch router: It will route our transaction in the most efficient way, offering the best swap rate. Direct Swap: Our deal will be routed straight via the Dex with the highest liquidity. It is not necessarily the most affordable. OTC (Over the counter): It is the best choice for transferring larger amounts. Our transaction will be routed off-chain through registered Private Market Makers.

Classic Mode It includes live charts, limit orders, flashbot transactions, and some other features.

In this section, we will understand how to use 1inch. Step 1: WalletFirstly, we need an Ethereum or BSC Wallet like MetaMask, Trust Wallet, etc., and buy some ETH, BNB, or MATIC. Step 2: 1inch AppFirstly, Go to the 1inch website. Click on Launch dApp.

Visit 1inch

Secondly, choose one of the available two modes, i.e., simple or classic.

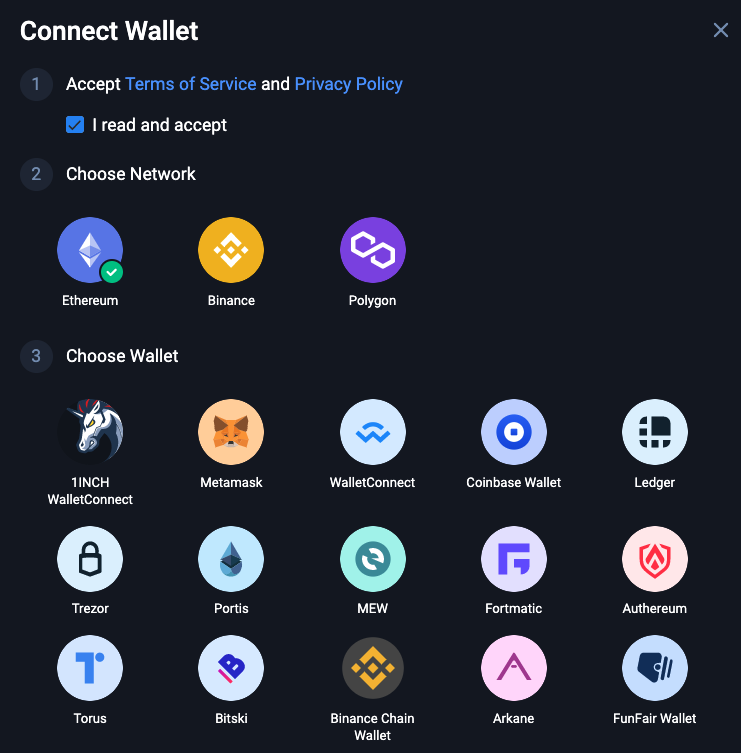

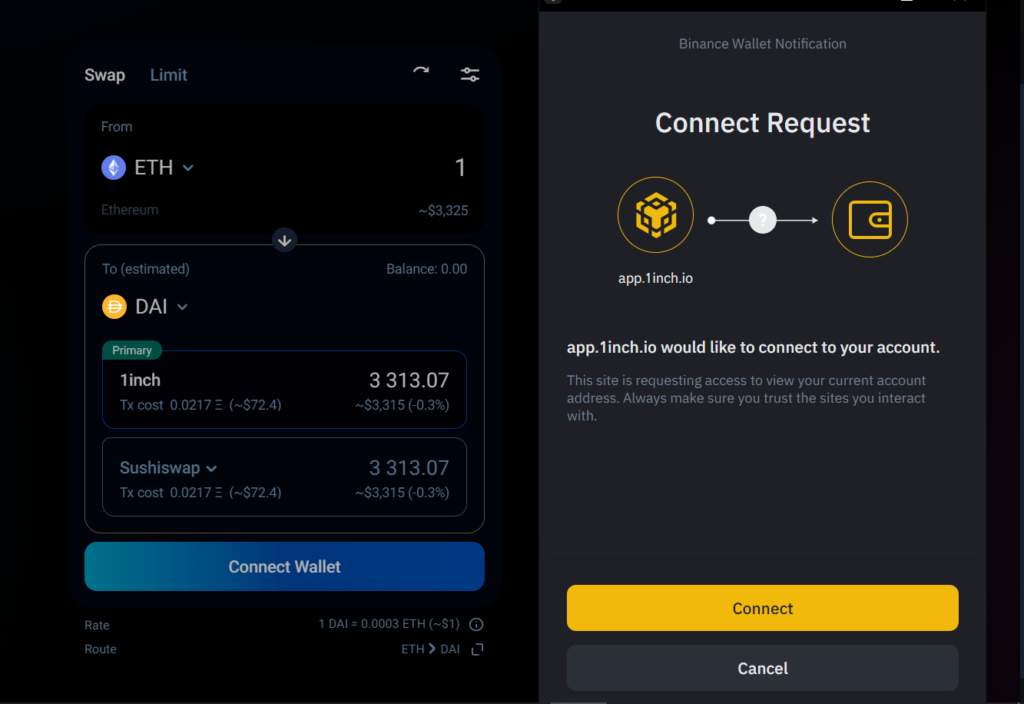

Thirdly, click on the Connect wallet button in the upper right corner. Click on I read and accept. Choose the Network and the wallet (e.g. Metamask) in the popup window. Then, click on the connect button.

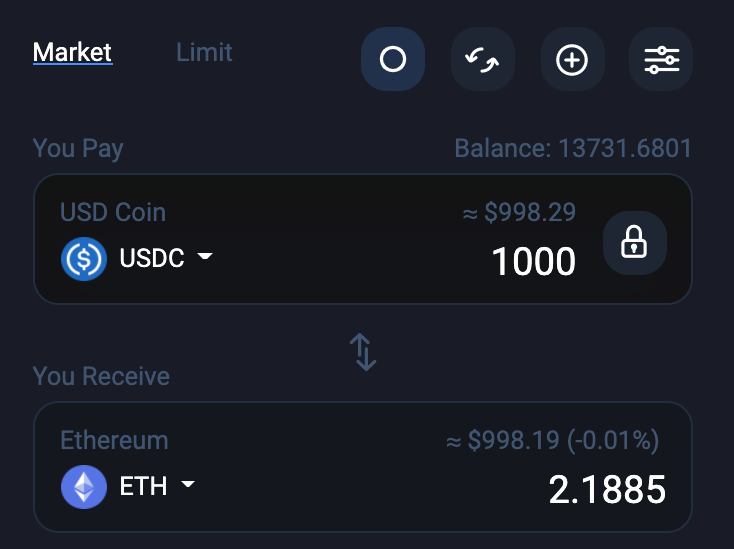

Ethereum address will be shown at the top of the page after the wallet has been linked. We can always check our transaction history, copy the address, or disconnect the wallet by clicking on it. Step 5: Selecting tokenSelect the token we wish to swap from the drop-down menu and enter the amount in the you pay area. Next, select the token we want to get in the you receive area.

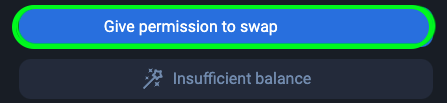

Click the Give permission to swap button. It grants permission and does not perform the actual exchange.

Click the swap token button, and then confirm the transaction in the wallet.

Wait for the banner in the upper right corner telling that transaction was successful.

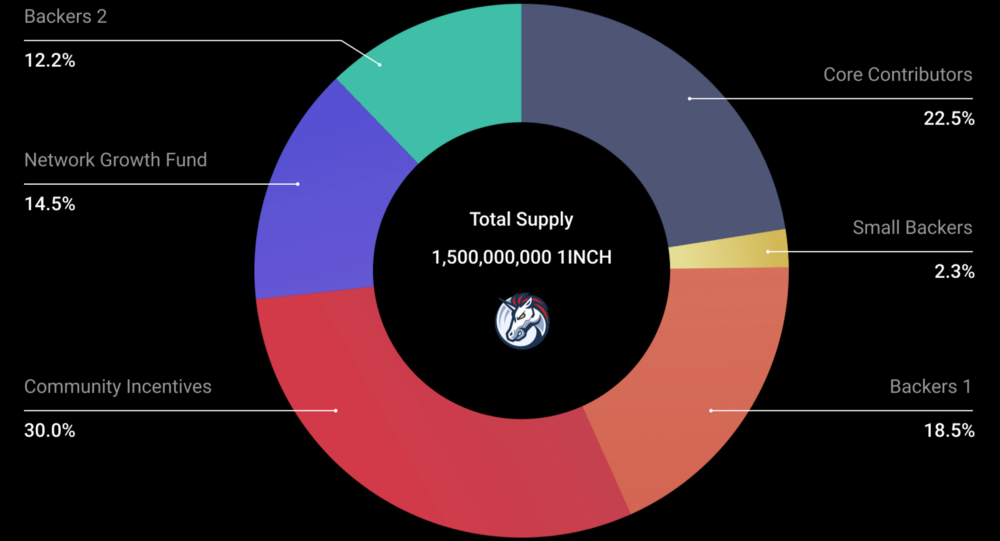

Introduction 1inch token is the 1inch Network’s native token. The way to obtain 1inch tokens is to provide liquidity to the 1inch liquidity network. As a utility token, it is utilized as a connector to enable high-efficiency routing in the 1inch Liquidity Protocol. As a governance token, we can use it to vote on how the 1inch platform is governed.

Get 1inch token Supply and Distribution

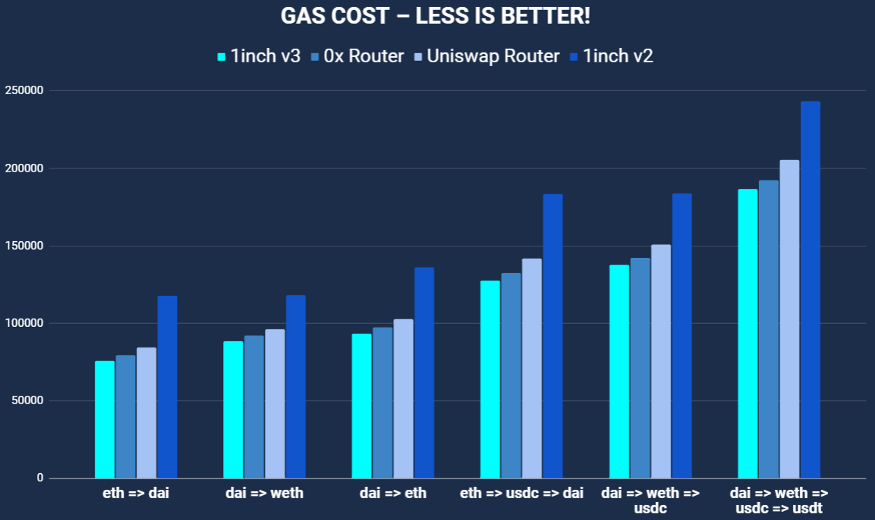

On November 5, 2020, the 1inch team launched Version 2 of 1inch. Features: Pathfinder: It is an API containing a routing algorithm that identifies the best potential pathways for a token exchange in the quickest possible time. This algorithm utilizes different market depths inside the same protocol. Speed: Comparison quote response time was cut from 6 seconds to 0.4 seconds; Page load time was cut from 5 seconds to 1 second; API quote response time was cut from 5 seconds to 0.4 seconds. UI: When developing the new user interface, the team considered user feedback and sought to make the UI as intuitive and user-friendly as possible. Versatility: Uniswap V1, Uniswap V2, WETH, Balancer, Curve, Chai, SushiSwap, Kyber, Oasis, Mooniswap, Compound, Aave, yEarn, Bancor, PMM, Cream Swap, Swerve, BlackholeSwap, Value Liquid, DODO, Shell are all supported by 1inch v2. Collateral: Users may now pack, unpack, and move collateral tokens from Aave and Compound lending protocols. Swap Overhead Optimizations: For direct swaps, such as Uniswap, V2 decreases aggregation overhead gas costs to almost nil. Partial and Dynamic Fill Mechanism: When a user swaps on 1inch utilizing split or other routes, 1inch ensures that the swap is completed at the rate that the user was given in the UI. Suppose the rate on one of the protocols changes, a portion of the route may be quickly cancelled. Instead of a failed transaction, the unswapped coins of the user are returned to their wallet. The dynamic component allows sections of the swap to move to another protocol in the split or route quickly. A swap, for example, is divided among Uniswap, SushiSwap, and Balancer. If the Uniswap swap fails, the full swap will be transferred to Sushiswap and Balancer. 1inch v3 upgradesIn March 2021, the 1inch team launched Version 3 of 1inch. Features: Transaction Fees: The potential to significantly cut gas prices due to assembly code optimization.

Liquidity: 1inch intends to maintain its position as a market leader in the DeFi area. By exchanging tokens on 1inch, consumers have access to the best liquidity value possible.

The future of 1inch depends on the future of DeFi. The popularity of DEXes is increasing so is the need for aggregators like 1inch. And since 1inch is the most popular DEX aggregator in the market it offers great potential. Furthermore, since we are witnessing the very berth of DeFi, there is a long way ahead, and it’ll be intriguing to observe what the future holds for DEXes and DeFi. (责任编辑:) |