|

Redefining corporate governance through transparency and openness for a sustainable future As sustainability gains importance globally, “corporate governance” has become a major focus in the business sector, forming one of the three pillars of ESG (Environmental, Social, and Governance). Traditionally centred on internal controls and management systems, corporate governance now encompasses the interests of various stakeholders and serves as a crucial metric of a company’s sustainability efforts. Beyond fulfilling environmental standards and honouring audit obligations, how can future businesses innovate in corporate governance and enhance sustainability, achieving triple-win outcomes for the business, the environment and society?

On this page...

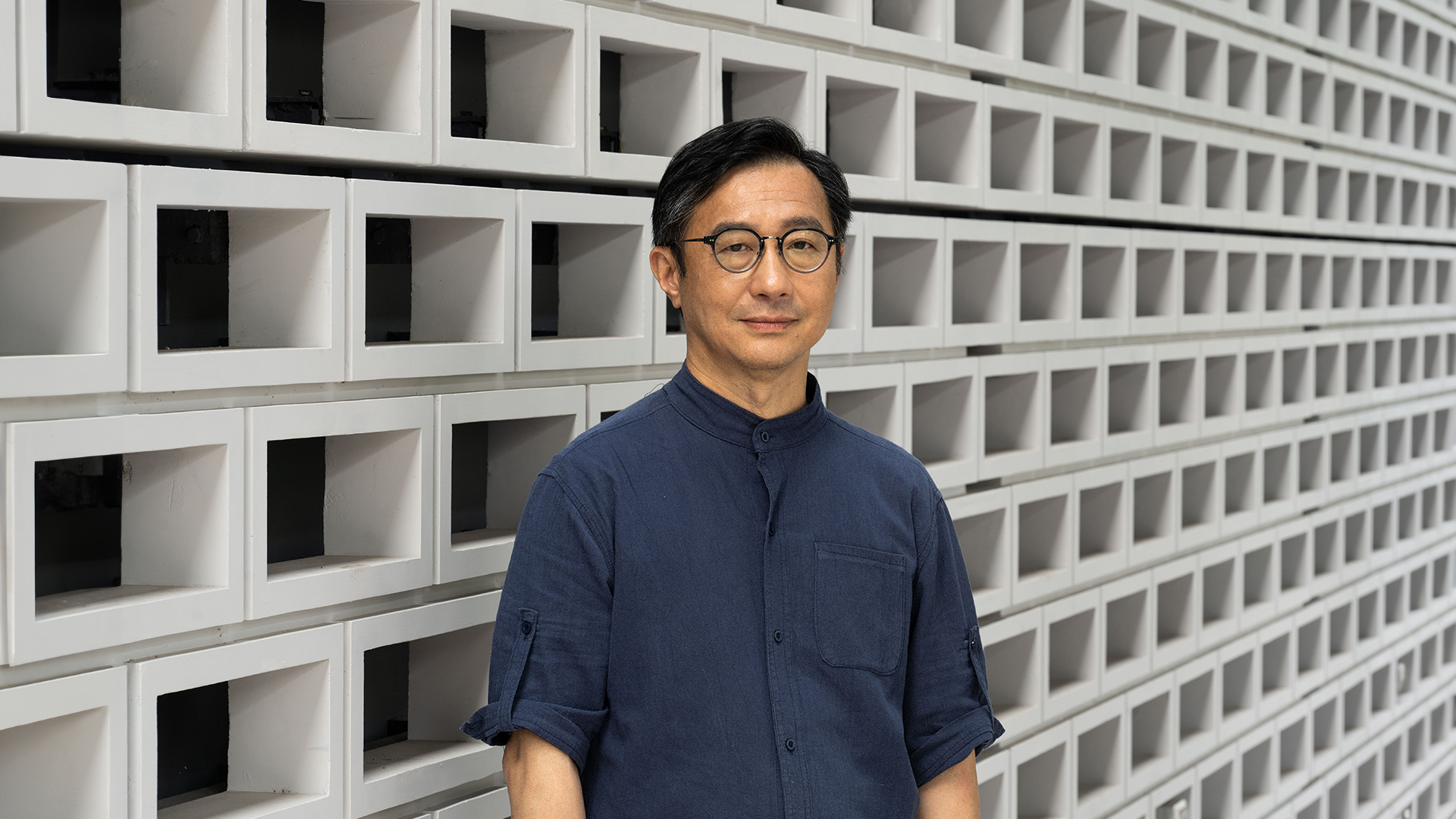

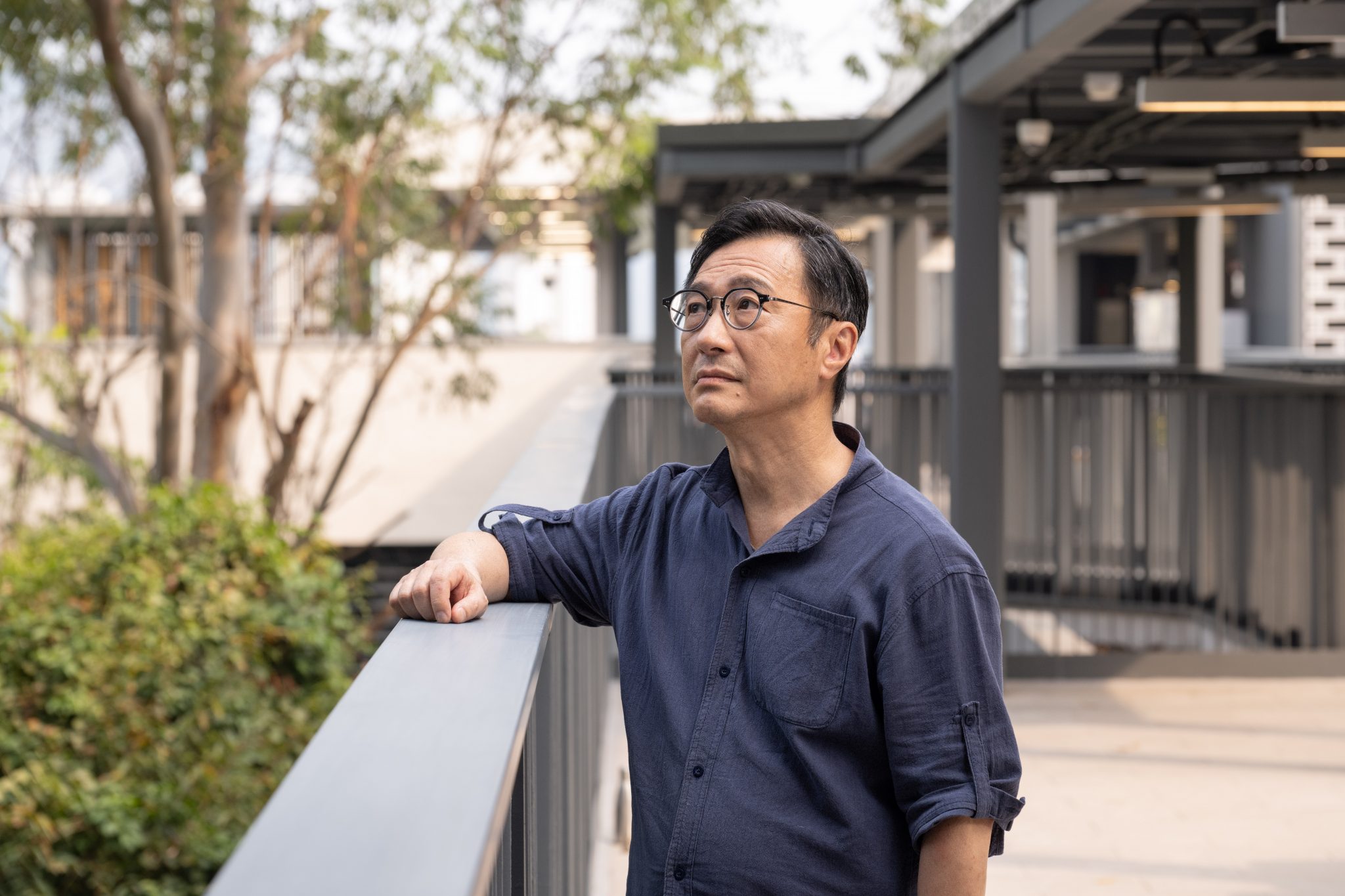

Corporate governance broadly refers to how a company balances the interests and interactions of investors, management, customers, suppliers, the government and other stakeholders, with transparency and trust at its core. According to a survey conducted by professional services firm PwC, 77% of investors expressed a desire to learn more about the ESG transformation of the companies they invest in. However, almost half of them indicated they would divest if companies could not take concrete actions or transparently disclose ESG information. Despite this, a report from a financial institution noted that enhancing operational transparency often necessitates significant capital and technology investment in building and maintaining data management systems, potentially risking the exposure of trade secrets. Consequently, many companies remain cautious about ESG disclosure. Proactive Reform Shapes Future of BusinessHarold Yip (BBA in Marketing 1987, EMBA 2001), who co-founded Mil Mill, Hong Kong’s first Tetra-Pak recycling pulp mill and education centre, offers a unique perspective. He strongly believes that enhancing corporate transparency can improve business operations. “By being transparent and allowing the public to see how we process recycled materials, we build trust with our customers,” he says, citing Mil Mill as an example.

While some companies may be uneasy about increasing transparency and do so primarily for ESG reporting purposes, Harold emphasises that his company fully embraces openness and the corporate governance ethos, a mindset that is elevating these concepts to a new level. For him, corporate governance is more than just fulfilling regulatory requirements. He actively invites public scrutiny of his company’s operations from start to finish. “There is already a lack of confidence in the recycling industry. I want to change that by showing people what paper recycling involves, and letting them see the entire process. After all, seeing is believing. This transparency has increased public trust in my company and restored faith in Hong Kong’s recycling industry,” he explains. Mil Mill operates on a self-financing business model, but high local labour and land costs have limited its profitability. Nonetheless, Mil Mill’s commitment to high operational transparency has yielded unexpected benefits. It has established Mil Mill as a credible and pragmatic operation, and this brand impact has fuelled growth in Harold’s other environmental ventures, including confidential document recycling and processing, integrated waste management and consulting services, which are now the company’s main profit centres. Harold notes, “In my operational model, once public trust in the company is built, it fosters a sustainable profit model.” His strategy aligns with society’s growing environmental awareness, transforming corporate governance from a perceived constraint into a significant business opportunity.

A study conducted by an international consulting firm validates Harold’s vision. It observed that companies excelling in ESG achieved annual total shareholder returns two percentage points higher than those excelling solely on financial metrics. This, in turn, indicates that companies with a strong commitment to ESG, especially those actively improving corporate governance, are not just meeting their social responsibilities. As a matter of fact, it is a crucial strategic move that can open new business opportunities, increase corporate value and enhance competitiveness. (责任编辑:) |